Operations

Get Paid Without the Pain: Smarter Direct Debit Strategies for Gyms

For most gyms across Australia and New Zealand, Direct Debit is the bread and butter of membership payments. It’s reliable, scalable, and, when done right, a total game-changer for cash flow and retention. But when things go wrong, like missed payments, awkward front desk chats, or members locked out of their workouts, it can mess with your bottom line AND with the member experience too.

The good news? A few smart tweaks to how you manage Direct Debit can make all the difference. Here’s how to take control of your payments, protect your revenue, and keep your members onside.

Why Direct Debit Is Still King

Direct Debit remains the top choice for gyms in both Australia and New Zealand – and with good reason. It automates payments, reduces admin, and creates a predictable income stream. Regardless of which provider you partner with, the ability to set and forget payments (for both you and your members) is a huge win.

But too often, direct debits are set up… and then left. Which means when something changes, like a member’s card expiring or their bank account closing, payments start failing and no one notices until it’s already a problem.

Let’s change that.

Regular assessments and feedback

Understanding your members and their payment habits is key. By recognising patterns and offering tailored solutions, you can help your members avoid payment issues before they arise. Here is what our data is telling us:

Bank versus Credit Card

Payments from credit cards are 2.5 times more likely to fail than bank account payments. Steering members toward bank debits can reduce failures and help them avoid dishonour fees.

Age

Younger members (aged 18–24 years) experience more failed payments – often due to financial unpredictability or outdated details. Regular prompts and easy update options can help.

Payment Frequency

Monthly payments are 60% more likely to fail than weekly ones. Smaller, frequent payments are easier to manage

Payment Size

Smaller instalments are up to seven times more successful. Encourage bite-sized billing to ease the pressure.

Alignment to Payday

Letting members align payments with their payday boosts success rates and lowers dishonours.

Offer Flexible Payment Options

The more flexible you can be, the easier it will be for your members to manage their payments without falling behind. Offering multiple options can help prevent payment failures and the dishonour fees that come with them.

-

Smaller, More Frequent Payments

Weekly or fortnightly billing reduces the size of each debit, making payments more manageable and less likely to fail. -

Pay-As-You-Go Options

For commitment-shy members, a pay-as-you-go model offers control without the upfront burden. -

Align With Payday

Offering payment cycles that match members’ paydays helps avoid missed payments due to bad timing.

Educate Your Members

The key to reducing failed payments is education. Helping your members understand the importance of keeping their payment details up to date and the consequences of failed payments can go a long way in preventing dishonour fees.

-

Keep Details Up-to-Date

Remind members to check expiry dates and update details before their next payment. -

Explain the Why

Make it clear what dishonour fees are, who charges them (hint: it’s usually not you), and how they can avoid them. -

Send Timely Reminders

A quick message before payment day gives members time to ensure their account’s good to go.

Leverage Technology

Technology can ease the administrative burden of tracking payments and reduce the likelihood of failed payments for your members. By using automated tools, you can ensure a smoother payment process without additional strain on your team.

-

Automated Retries

If a payment fails, automation can retry it – no need for manual follow-up. It's efficient, discreet, and often successful. -

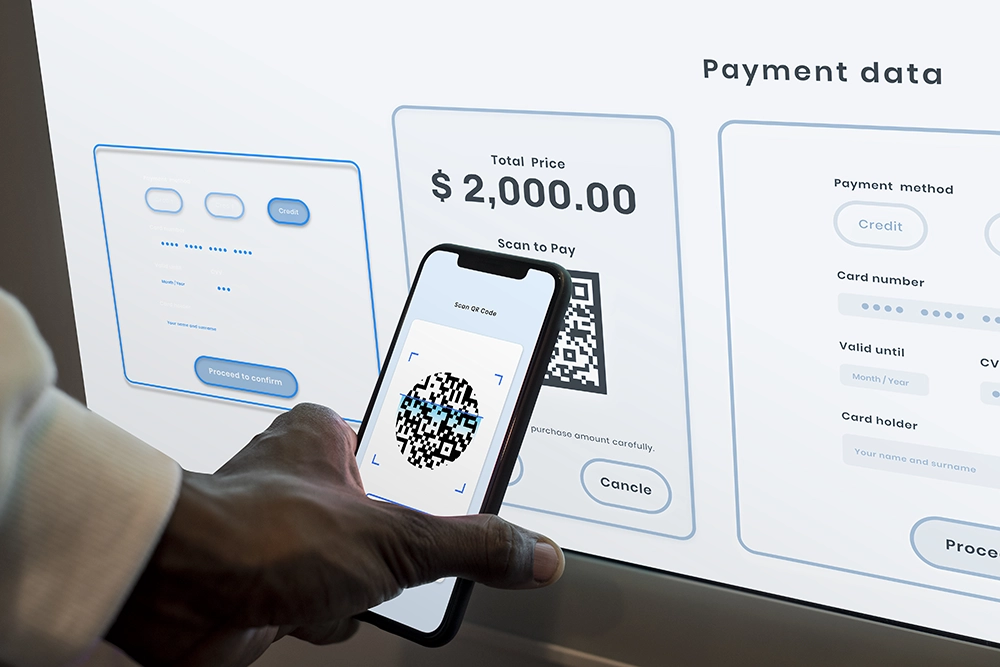

Mobile Access

Members manage life on their phones. Make sure they can update details or pay from their device in seconds.

Review Your Payment Policies

Having clear, transparent policies in place will help your members understand what’s expected of them and what they need to do to avoid dishonour fees. A well-structured policy benefits both your gym and your members.

-

Set Expectations Early

Clearly outline fees and payment terms during sign-up and onboarding. -

Be Consistent

Stick to your policy. Members are more understanding when rules are applied evenly.

Wrap Up

Helping your members avoid dishonour fees is all about providing the right tools and support. With the right setup, support, and systems in place, you can reduce payment failures, cut admin time, and keep your members happy.

Toni Rennie

Toni has over a decade of experience in marketing. As the Marketing Director for Xplor Gym in Australia and New Zealand, leading all things brand, content, and lead generation across the region, Toni is focused on helping gym owners discover smarter, simpler software that supports growth, strengthens member engagement, and brings their business goals to life. When you’re ready to make managing payments easier for everyone, Xplor Gym can help. Get in touch to learn how to streamline your payment process and take one more thing off your plate.